Yet not, when the Pit is out there, an excellent waiver shall be offered both for bits of collateral. When multiple waivers can be purchased and something of your vehicles try totaled otherwise taken, then your claim will be modified in line with the fee worth one to vehicle signifies with the loan. Such, if for example the guarantee protects 50% of one’s loan, CUNA often to change the newest allege based on half the mortgage well worth during loss.

Possessions that will be qualified to receive Pit tend to be: Motor vehicle – personal passenger automobiles, vehicles, light vehicles; 20 design age otherwise new.

- Conventional finalized-end money

- Refinances (away from another type of financial)

- Security financing (loans useful for almost every other intentions)

- Open-end funds (draws particular for new and you may put vehicles financing)

Zero, Pit try a financial obligation cancellation work with and needs to-be tied to help you a loan, protected from the equity becoming secure.

Gap try voluntary and can end up being cancelled any time from the getting CUNA authored find away from termination. To possess cancellations, finish the termination mode and you may yield to CUNA Mutual Insurance company, Inc. On 90-date trial period, Members has actually 3 months, out of subscription big date, to cancel coverage and you will discovered a complete reimburse with no cancellation commission. Immediately after 90 days, zero reimburse is due in the event the Associate cancels just after ninety days.

Home loans

Zero. In case your car are substituted as opposed to one which possess a space Waiver, the customer will need to buy a different Gap Waiver. However,, should your customers will get a new automobile into the ninety-time 100 % free research period, then they can get the full refund into brand new loan, and buy Gap to the the fresh loan.

Standard

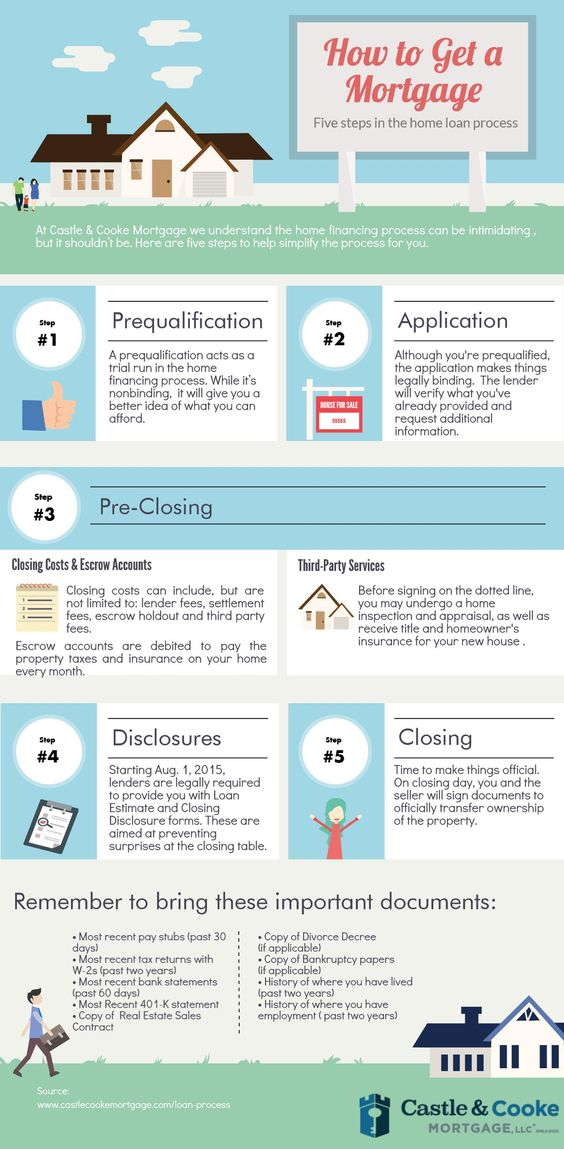

A home loan was a loan which is used to shop for or refinance a house. In return for the mortgage, you only pay notice into the count loaned. The lender also has very first legal rights in your household however if your are not able to pay off the mortgage.

- Number (exactly how many cash you really need to obtain)

- Rate of interest (the new fee speed you have to pay toward mortgage)

- Title (the length of time it is going to sample pay back the loan, fundamentally 10, 15, 20, or 3 decades)

All of these areas effect simply how much your mortgage payment usually getting. The greater the rate, brand new faster the term, or even the large extent, the higher the month-to-month mortgage repayment. You may have power over the quantity and you will name, nevertheless the price is basically place by the market. Yet not, because of the shopping around you’ll find the absolute most advantageous price possible and lender having whom you become beloved.

The mortgage-to-well worth (LTV) ratio ‘s the amount of cash your obtain weighed against new lower of your own rates or appraised worth of your house you might be investment. For every loan enjoys a particular LTV restrict. Such as for instance, which have an excellent 95% LTV mortgage for the property priced at $a hundred,000, you might obtain around $95,100 (95% regarding $100,000), and perform spend $5,000 once the an advance payment. Brand new LTV proportion shows the amount of equity consumers has inside the their houses. The better the new LTV proportion, the brand new less of your budget homeowners must lower of their unique money. Thus, to safeguard loan providers facing possible lack of question of default, large LTV loans (80% or higher) constantly want a private financial insurance coverage (PMI) rules.

PMI signifies « Personal Home loan Insurance rates. » PMI are an agenda applied for of the home financing business to guard the financial institution however, if you might be unable to create your mortgage repayments while the bank forecloses. Although not, PMI do absolutely nothing to manage your, the new debtor. Once you took out the loan order your household, the lender added the expense of it insurance policies with the monthly fee unless you generated at the very least a beneficial 20% down-payment. After you repay an adequate amount of the mortgage in order to meet this 20% endurance, you happen to be eligible from inside the nearly all times having this payment decrease if an assessment signifies that your loan is truly 80% or a reduced amount of your domestic worth. Since the majority home generally boost in value, this problem is commonly found ahead of 20% of your loan try reduced. Its better if you get hold of your bank otherwise financial servicer so you’re able to discover what’s needed to eliminate https://www.cashadvancecompass.com/loans/loans-for-400-credit-score/ PMI from your home financing.