A good U. USDA home loans are intended for homebuyers with reduced in order to reasonable profits or those individuals to order for the first time.

Even after the outlying notice, these types of loans commonly arranged for producers and are obtainable with other home buyers. Because of the expansion of the USDA system, consumers looking to purchase a house otherwise re-finance one in outlying or even suburban parts you can expect to qualify for a great USDA financial even if they don’t meet up with the basic for a traditional home loan mortgage.

Master among the many benefits of this an excellent USDA home loan is actually the fresh no downpayment ability, distinguishing an effective USDA mortgage from other home loan affairs.

On top of that, rates of interest for the USDA home loans become all the way down opposed with other mortgages. The credit requirements also are basically more stimulating.

If you’d like to learn how to apply for a good USDA mortgage or just how to be eligible for a good USDA loan, keep reading and we’ll promote answers to those people questions having https://paydayloanalabama.com/daleville/ your.

Carry out USDA Financing Enjoys PMI?

Traditional fund which are not supported by the us government do wanted PMI. These insurance policies cover the lender if your borrower defaults for the financing. A great USDA mortgage doesn’t have brand new PMI requirement, given this might be an element in the homeowners who happen to be putting down lower than 20% of the purchase price of the property.

If you are USDA finance leave PMI, one other insurance coverage standards for the which loan are a couple of-pronged. Borrowers must pay what exactly is also known as an initial make sure fee and you may an annual percentage to pay for home loan insurance premium.

The newest initial be certain that commission, that will additionally be called the USDA financing fee, number to 1% of sized the borrowed funds loan, given that yearly commission will cost you 0.35% of your own mortgage. New capital fee is typically due at the closing, and it also would be together with the home loan. The latest yearly fee will get an element of the borrower’s month-to-month financial payments.

Even with these charge, USDA financing however tend to have straight down full will cost you against. traditional home loan items, predicated on Neighbors Bank’s Sam Sexauer, cited by the USDAloans.

USDA compared to. Old-fashioned Fund

Conventional financing goods are however the most used version of home loan having American homeowners, however, USDA fund cater to a certain group. There are a few crucial differences between the 2 more home loan products.

The credit conditions associated with a good USDA loan become all the way down, just like the regulators is looking to market homebuying into the parts additional regarding locations. Potential homebuyers whoever credit score means specific functions could still meet the requirements getting a beneficial USDA mortgage, given that credit standards be strict for antique funds.

Whenever you are lenders usually work with a keen applicant’s FICO score, brand new You.S. bodies relies on its own borrowing method via its Secured Underwriting System, with so much more independence than many other options.

USDA money along with are apt to have down interest rates affixed vs. antique finance, making it possible for lower-money homebuyers in order to borrow at a cost one opponents people that have pristine borrowing.

Traditional loans you’ll offer varying-price mortgage loans. The overall costs associated with a vintage financial can be as very much like two or three minutes higher than USDA home loans, blocking certain reduced-income or earliest-go out potential home buyers of to get homeowners.

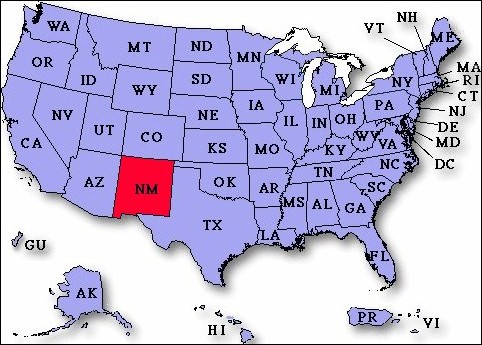

On the bright side, USDA financing deal with geographical limits since they’re intended for qualities situated in outlying portion. Old-fashioned fund do not satisfy this type of same geographic restrictions.

At the same time, the brand new homebuyer having a USDA mortgage have to decide to use the assets as his or her primary quarters. On the other hand, a normal financial could potentially be employed to pick an investment property, for example.