City Speed-Upto fifty% Off

When i was going to remove a mortgage toward my personal paycheck from Rs. 40,000, I called my personal Banker friend. I inquired him how much financial must i log in to forty 000 income. He said that amount borrowed would be somewhere between Rs. twenty-five – Rs. twenty seven lakhs.

He states, extent the guy only stated is found on an interest rate away from 8.4% p.a. and you can a loan period out-of three decades. To know about the particular number, the guy explained to use the fresh NoBroker mortgage eligibility calculator.

From that point, I happened to be able to see the mortgage to your 40000 salary you to definitely I am able to rating, that was just Rs. Lakhs. I am hoping that it solutions the query about far casing mortgage should i log in to 40000 paycheck.

Urban area Speed-Upto 50% Out of

Lifetime straight back, whenever my personal income is actually 40000, We grabbed away a home loan. So, first of all I did so immediately after going to the lender was to ask the borrowed funds executive, « How much cash financial ought i rating having 40000 salary?

The guy told me that we was eligible for a cost one can be somewhere within Rs24 in order to Rs26 lakhs. The guy informed me that we you are going to increase my home loan qualification if want a loan which have increased matter. Check out of details stated because of the your.

According to my pal, finance companies courtroom anybody considering the credit scores. Its pretty easy for individuals with a credit rating off 750+ to help you secure a loan and also have a top matter. If your credit rating are less than 750, then explained to alter it if you are paying away from every the newest EMIs and you will borrowing from the bank expenses.

The latest offered the latest period, the greater number of date you will need to pay off the mortgage. He mentioned that, easily selected a longer period, this new EMIs would be far lower also.

Choosing a mutual financing is yet another simple way to change family financing eligibility the guy said. Whenever choosing a combined loan, money of both applicants are believed by lender.

Therefore, which is how much home loan to own 40000 paycheck, you can expect. You can proceed with the significantly more than ideas to replace your financial qualification as well. I really hope the query on how far mortgage must i rating which have 40000 paycheck could have been fixed.

City Tempo-Upto 50% Regarding

Mortgage brokers with different borrower-amicable courses have really made it simpler for those who have credible incomes to become home owners in the a young age as a result of the skyrocketing price of real estate. I was one such youngster just who wondered my salary is 40000 must i get a property? Just after much time talks with my mothers and you can comprehensive browse, I did so get home financing.

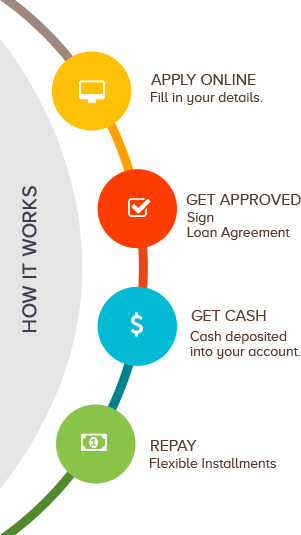

From inside the procedure for applying for a home loan for 40000 paycheck, I realised that the process is easy: the brand new debtor welcomes a lump sum payment from the financial to help you buy the home, and additionally they after that come back the loan as a result of a series of equated month-to-month instalments (EMIs) that include attention.

Brand new sanctioned amount of financial to your 40000 salary, varies, however, according to the applicant’s amount of earnings. A beneficial jobholder’s main priority whenever obtaining a mortgage was ergo just how much they’ll certainly be capable acquire. Its basically approved a loan qualifications expands that have paycheck because the a rule of thumb. However, there are a number of character at work.

40k paycheck home loan qualification standards

Age: However this is rather have lending currency to young individuals between your years out of 21 and you will 55 for lenders. Young candidates have a top risk of paying down the loan because might probably functions offered.

Employer and you will performs experience: Considering the cover inside, applicants who do work to own respected organizations has actually increased risk of delivering a property financing acknowledged. The debtor comes with the promise one their EMIs was paid off on time because of this. Your employment records is very important and you will reflects well on your balances.

Credit rating: Even if you build a good way of life, a low credit score normally damage your chances of being approved to own home financing. However this is usually require a credit score from 700 or even more.

Established obligations (called Fixed Duty in order to Money Ratio otherwise FOIR): New FOIR tips exactly how much out of somebody’s month-to-month net income goes toward purchasing the overall month-to-month obligations. Having qualifications, a limit out-of below fifty% is generally expected.

LTV (Loan to help you Worthy of): Though your websites monthly income are large, creditors simply funds as much as 75 so you can ninety for every penny of your own entire cost of a property. In the event of a standard, this will make it very easy to reclaim the money of the promoting the root resource.

Property’s legal and you will technology acceptance: Creditors evaluate applicants that are considering to order a home centered with the several requirements. Very first, the house need a very clear identity and you may owner, and next it will has a fair industry value. These types of examination are usually done by unprejudiced lawyer and valuers you to definitely financial institutions has hired.

How much cash household mortgage must i log on to 40000 salary?

You are questioning what type of home loan you are qualified to receive considering the month-to-month salary. It is a valid thing once the determining the newest property’s budget utilizes how much cash from a home mortgage you qualify to have. Finance companies typically agree home loans to own 20 so you can 30 years which have monthly payments you to equivalent fifty% of your own borrower’s websites wage. Their month-to-month repayment possibilities might possibly be Rs 20,000 whether your net wage is actually Rs forty,000. (fifty percent cash).

You’ll be provided a loan of approximately Rs 24-twenty six lakh. You could potentially alter the aforementioned variables in accordance with debt requirements to obtain a right guess of the property mortgage amount.