Your residence will be the prominent pick you previously build. Deciding to pick property is a big decision, making it important to verify it is a thoughtful alternatives too. Finding the time knowing how qualifying to possess a mortgage loan performs will assist make procedure while the rewarding while the enjoyable.

When you submit an application for your loan, mortgage brokers will appear during the a variety of pointers. However it in the course of time comes down to these about three one thing: your borrowing, earnings, and possessions.

step one. Your Borrowing from the bank

Loan providers will remark your own record with a request to the around three major credit reporting agencies TransUnion, Experian, and Equifax. All the information it collect can assist all of them take advantage of advised decision regarding mortgage degree process.

Alongside your credit history is a determined credit score, called an effective FICO get. Your credit score vary from three hundred-850.

Lenders set their unique standards for just what scores they are going to take on, nevertheless they fundamentally think about your payback history, whether or not the payments have been made promptly, just in case the loan was paid off in full.

Your credit score is actually a deciding grounds that have a mortgage qualification, and it support dictate the interest rate that you receive. The greater their score, the simpler its to help you be eligible for home financing.

Now that you’ve an understanding of borrowing from the bank, it is possible to question simple tips to change your get. Imagine both your credit rating therefore the statement the number appear of too.

Discover problems or obligations quantity detailed that do not end up in you. Should you discover errors, take care to get in touch with new creditor and you can argument them precisely. The creditor’s information is listed on the statement to own simple resource.

2. Your income

2nd, your income also issues in the qualification procedure. Loan providers will assess your debt-to-money (labeled as DTI) proportion. Their DTI comes with any repaired costs – costs which can be an equivalent matter every month – as well as the the fresh new mortgage.

This type of costs is actually after that examined facing their gross monthly income (before every taxation are deducted). This helps your own bank see whether you’ll be saving cash than the required fifty% of disgusting monthly earnings with the people repaired expenditures.

Ranged costs such resources, wire, otherwise devices are not as part of the DTI proportion. You could store this while the a simple reference to own terms to help you understand in the procedure.

step 3. Their Possessions

![]()

Possessions are also important to the newest qualification process. Assets are things you very own that have a monetary value. For this reason, hardly any money you have got when you look at the accounts that could be drawn away since bucks can be detailed given that a secured item.

Bodily assets will be ended up selling to have funds to better be eligible for home financing. Such property are, but are not limited so you can, things such as for example features, house, trucks, vessels, RVs, jewellery, and visual.

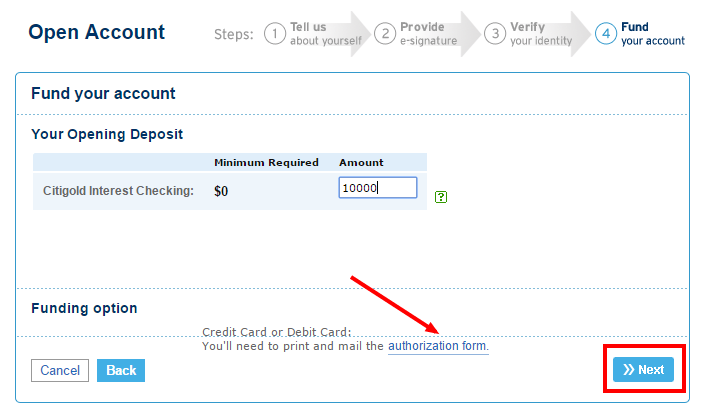

The financial institution ple, they will certainly should guarantee the amount you will end up using to your deposit is accessible into the a liquids dollars membership, such as an examining or family savings.

Including, according to the variety of investment you happen to be looking to, there can be a requirement to possess a reliable cash set-aside. Supplies differ from property due to the fact a reserve is what you’ve got remaining prior to an advance payment or investing any settlement costs. These types of set aside requirements be more prominent of trying to order a great next household or investing in a home.

Tying They Together – Know Your loan Versions

I chatted about the necessity of your own FICO score prior to, however it is useful to remember that certain real estate loan designs provides flexibility in scoring certificates.

A traditional mortgage try home financing perhaps not funded by the an authorities department. Most old-fashioned loans was supported by home loan enterprises Federal national mortgage association and you can Freddie Mac computer. An average lowest FICO score out-of 620 is generally recommended when applying for payday loans online Oregon a conventional mortgage, but loan providers usually make individual devotion with this.

Va financing is secured by U.S. Department out of Pros Items. These include meant for pros, active-obligations military participants, and qualified surviving partners. This new Virtual assistant does not put the very least credit rating for those money, and you can loan providers can develop their particular requirements.

Mortgage loans supported by the fresh Federal Houses Administration (FHA) are designed for basic-big date home buyers and you may lower-to-modest money consumers. These types of finance require smaller down costs than many other variety of mortgages.

New You.S. Agency from Construction and Urban Innovation states you may want to be eligible for an FHA financing which have a credit score away from five hundred provided that since you set-out no less than 10%. Having increased FICO credit history-at least 580-you can also be considered having a downpayment as little as step 3.5%.

Higher Colorado Credit Commitment Mortgages

At Deeper Colorado Borrowing Union, our team is ready to help you choose a mortgage loan to match your needs. We understand qualifying getting a mortgage try yet another techniques. Therefore looks more for all considering credit, assets, and you may income may differ.

Mouse click lower than for more information on delivering an interest rate off a card Union. Otherwise write to us when you yourself have issues. Our company is usually here to aid!